Making Significant Efforts in Five Great Articles on Finance—Fehorizon Promotes Technology Platform Innovation and Develops Digital Financial Services to Serve Real Economy

Recently, Global Digital Economy Conference 2024 was convened in Beijing, and various parties from governments, financial institutions and academic circles held discussions surrounding the theme “integrate digital and real economy and jointly promote development”. It was agreed at the conference that the digital technology revolution has become an important driving force to promote changes of the world, the era and the history. Developing digital economy and digital finance is the inevitable choice to embrace the new round of technology revolution.

Today, under the general trend of industrial digitalization, technologies like big data, blockchain and IoT are getting mature by the day, and the finance sector has taken the lead in realizing LiveApp and iterative upgrade. In particular, the development of supply chain finance deserves our attention—it is an important content of national strategy, and furthermore supports the development of real economy as an important hub connecting finance and industry by guaranteeing smoothness, stabilizing the chain and resolving difficulties.

Fehorizon actively embraces digital revolution. Surrounding core business transactions, by increasing the innovative use of digital supply chain, Fehorizon has created the Yuanhong Yilian Supply Chain Technology Platform and a variety of online digital supply chain products. Up to now, the Platform has served more than 1000 clients, including over 270 core enterprises and over 800 suppliers for small and medium-sized enterprises, and cooperated with more than 20 financial institutions with total financing amount exceeding 7 billion yuan.

Creating the Supply Chain Technology Platform and Providing Secure and Efficient Services

In finance, credit transmission is the key. The traditional financial system relies on intermediaries to establish and maintain credit relations. However, this way is often inefficient and expensive, and accompanied by frequent occurrence of trust crisis as it is easy to tamper with and fabricate data. The high-quality credit and low financing cost of the top core enterprises in the lowest reaches of the supply chain cannot be conducted to any of their upstream suppliers. As the latest generation of information technology, electronic claim certificates for receivables are immutable, decentralized and capable of credit transmission, and thus ensures the authenticity and tamper resistance of data. Such mechanism not only guarantees the authenticity and traceability of transactions, but also greatly enhances the transparency and credibility of financial transactions. All suppliers in the supply chain of core enterprises can enjoy lower financing cost and a more convenient financing channel.

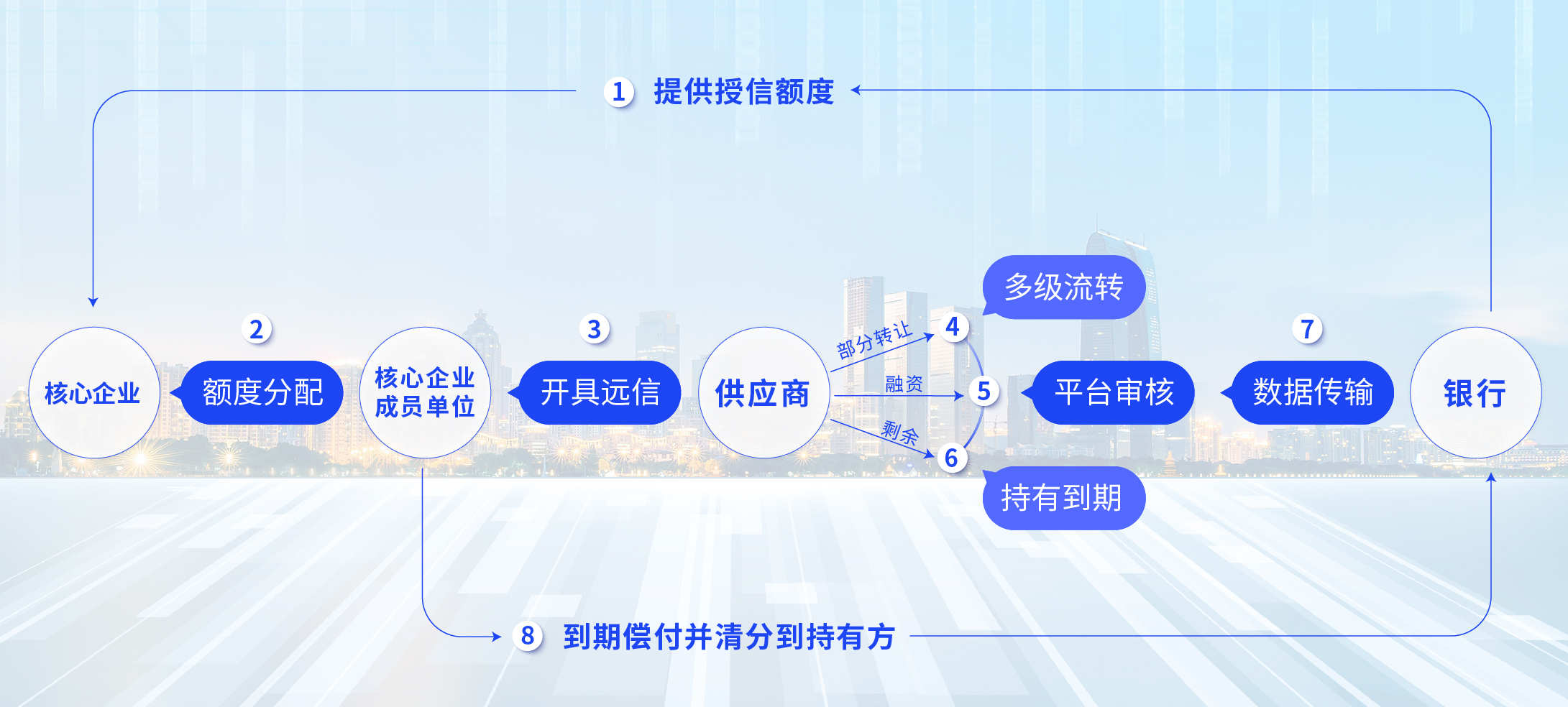

“Honglian factoring”—the star product of the Yuanhong Yilian Supply Chain Technology Platform (the “Platform”) can convert the payables of core enterprises upon confirmation into separable, negotiable and financeable digital claim certificates. The credit transmission based on core enterprises can on the one hand help suppliers, small and medium suppliers in particular, to lower the financing threshold and risk pricing; on the other hand, through multilayered and transmission-type supply chain trade management, it can help financial institutions to effectively improve their risk control ability and efficiency.

For clients to register and log on the Platform, multiple technical and data services (such as business license OCR, personal documentation OCR, verification of personal information, verification of business information, verification of small transfers to corporate accounts etc.) have been adopted, so that clients can complete the process independently in about 10 minutes, which has greatly boosted business efficiency and identity authentication accuracy.

The Platform offers two authentication methods including “SMS verification code + small transfer” and “UKEY authentication”, adopts the CFCA (China Financial Certification Authority) digital certificate, and supports electronic contract signing with enterprises. At present, “Honglian factoring” has been directly linked to the systems of more than ten banks to realize whole-process online operation for clients, e.g., registration, L/C issuance, transfer, financing and repayment clearing. The Platform has enabled automatic primary risk screening by the system with invoice system check and preliminary debt audit, and reduced about 30% of labor input by improving the Platform’s automated operation capacity. It takes 10 hours on average from the client’s financing application to the bank’s granting of loan, while under the traditional mode this process requires at least a week.

In 2023, the Yuanhong Yilian Supply Chain Technology Platform has obtained the recordation certificate for Level 3 security protection of the network security information system and reached a high level in the financial industry. The Platform conducts encrypted storage of data during multiple steps including client registration, electronic certificate issuance and signing. To obtain evidence, a valid attest report issued by CFCA or an internet court is required, so as to prevent trust crisis resulting from data tampering and fabrication.

Innovating the Digital Service Mode and Contributing to the Diversified Financing of Central and State-owned Enterprises

Certain large port group in Jiangsu Province is a large local state-owned enterprise group with more than 5 billion yuan of registered capital and 152 subordinate members. This group has chosen the Yuanhong Yilian Supply Chain Technology Platform to introduce capitalist supply chain funds, and fully guaranteed security and effectiveness with the application of digital means such as online e-signature and online invoice verification, in particular with the use of CFCA digital certificate in electronic signing. Under the guidance of Fehorizon, core enterprises use “Honglian factoring” to issue a L/C to their suppliers, and then the suppliers can discount, transfer or hold the L/C to maturity. In the fastest case, the supplier receives funds on the same day.

It is exactly the application of those high-tech digital tools that helps the Company while serving this port group to form whole-chain visual management, guarantee data security and enhance trust between various steps. What’s worth mentioning is that this case is awarded as “Typical Case of China Equipment Manufacturing, Logistics and Finance Development Forum” and “Excellent Case of Financial Innovation”.

As an important link of the Five Great Articles on Finance, the development of digital finance plays a significant underlying role in speeding up the construction of financial powerhouse, and functions as the basic support and important engine for the four great articles of technology finance, green finance, inclusive finance and old-age care finance. As always. Fehorizon persists in serving the real economy, resolves around clients, focuses on their needs and experience, and insists on providing clients with value and convenience. In the future, Fehorizon will keep developing digital finance, take digital technology as the foundation, innovate business scenarios and service modes, establish advantages in convenience and inclusiveness, offer clients a wider range of financial and industrial services, expand the scope and domains of business, embrace innovation, and seek joint development in the future wave of digitalization and intellectualization through cooperation.