Financial Leasing

FEHORIZON Leasing (International Far Eastern Leasing Co., Ltd., Far East Horizon(Tianjin)Financial Leasing Co., Ltd., and Far East Horizon Financial Leasing (Guangdong) Co., Ltd.)is the core platform in the domestic field of financial services as the leading financial leasing service provider in China. FEHORIZON Leasing offers comprehensive financial solutions focusing on financial leasing, assists clients in solving all financial and capital problems encountered in their development, and actively provides all-round value-added services including financial management, business operation, asset management and management consulting. It introduces domestic and international advanced equipment and technologies to corporate clients, improves their productivity and production efficiency, contributes to their transformation and upgrade, and supports them to quickly seize market opportunities. Through further updating the existing assets of clients, it helps them to achieve optimal development. As a pioneer and forerunner of China’s financial leasing industry, the FEHORIZON financial leasing business has gained a considerable edge in the fundamental areas of the social economy that concern national economy and people's livelihood. Through continuous innovation of its service system, FEHORIZON has become a vital force in promoting the innovation and development of China’s financial leasing industry.

Products Introduction

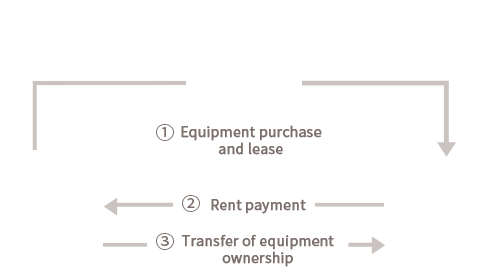

Direct leasing of equipment

Meeting capital needs of enterprises in purchasing equipment, and helping enterprises to introduce key equipment and upgrade for production expansion.

- High financing proportion

- Long maturity of financing

- Flexible reimbursement method

- Convenient approval for credit extension

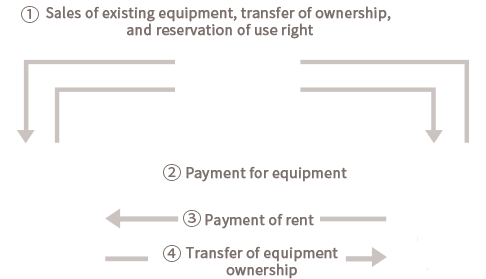

Sale-leaseback

Revitalizing existing equipment assets, achieving highly flexible medium- and long-term capital reserve, and fulfilling all-round capital needs for daily operation, debt replacement, project investment, etc.

- Revitalization of stock assets

- Recyclable line of credit

- Flexible use of funds

- Fast loan granting

Service Scenarios

Deeply involved in industries, offering financial leasing services from the perspective of the industry.

-

Urban Infrastructure Construction Urban Municipal Services Urban Operation Services, etc.Urban public utilities

Urban Infrastructure Construction Urban Municipal Services Urban Operation Services, etc.Urban public utilities -

General Hospitals Specialized Hospitals Old-age Care and Rehabilitation Institutions Medical Circulation Enterprise Services, etc.Healthcare

General Hospitals Specialized Hospitals Old-age Care and Rehabilitation Institutions Medical Circulation Enterprise Services, etc.Healthcare -

Construction Real Estate Energy Building Materials, etc.Engineering construction

Construction Real Estate Energy Building Materials, etc.Engineering construction -

Cultural Media Package Printing & Paper-making Traffic & Transportation Chemical Raw Materials & ChemicalsIndustrial Business

Cultural Media Package Printing & Paper-making Traffic & Transportation Chemical Raw Materials & ChemicalsIndustrial Business

Service Advantages

With distinctive insights into major industrial sectors and an extensive nationwide service network, FEHORIZON Leasing provide comprehensive one-stop financial solutions for Chinese industrial enterprises, continuous improvement of social welfare.

-

Service Network

- Localized services with over 1,000 personnel More than 20 central city service outlets Regionally-focused resource network

-

Marketing Reach

- Powerful customer service capabilities Thoughtful demand analysis capabilities Efficient resource coordination capabilities

-

Professional Competence

- Industry-leading team of business experts Deep understanding of regional market dynamics Comprehensive enterprise + entrepreneur solutions