FEHORIZON continuously identifies, evaluates and analyzes risks and opportunities related to climate change in accordance with the TCFD framework, effectively manages climate change risks while seizing climate change opportunities, and minimizes the carbon footprint of our operations in response to the concerns of global governments, investors and other stakeholders about our actions of addressing climate change.

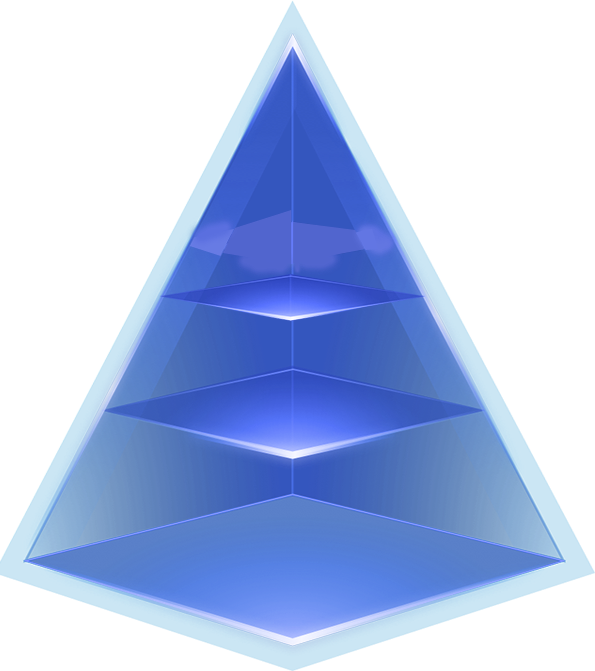

Board of Directors

ESG Committee under the Board of Directors

ESG Task Force

Relevant departmental and staff

- Governance level

-

The Board of Directors is responsible for reviewing and approving climate-related work of the Group and fully supervising climate-related risks and opportunities;

The Board of Directors has set up the ESG Committee chaired by Independent Non-executive Director and authorized the ESG Committee to study and give suggestions on the climate-related guidelines and practices of the Group;

The ESG Committee reports important climate-related issues to the Board of Directors through reporting from time to time and Committee meetings that should be held at least once a year based on the progress and key nodes of climate-related work.

- Management level

-

It is composed of multiple functional departments of the Group. CFO serves as head, and Vice President of the Company as deputy head to provide guidance on relevant work;

Assisting the ESG Committee in fulfilling decision-making and supervision responsibilities of climate-related work, coordinates the business lines of the Group in pushing for management of climate-related work of the Company and carrying out specific work;

Reporting the achievements and progress of climate-related work to the Board of Directors and the ESG Committee on a quarterly basis;

Including the progress toward realizing GHG emission reduction targets into the performance appraisal indicators of relevant departments of the ESG Task Force and business units;

- Execution level

-

The Investor Relations Department, the Strategic Center, the Human Resources Department and the Treasury Center are the core of the execution level. Core personnel of relevant departments and subsidiaries provide support to jointly advance execution of climate-related work.

Climate Strategy

Physical Risk

-

Business Scope:

HCHORIZON, CDHORIZON, FEHORIZON ASSET MANAGEMENT, Financial Business

-

Asset Types:

Office Buildings, Warehousing, Highways, Educational Facilities, Photovoltaic Facilities, Agriculture, Water Treatment, Healthcare Facilities, other Manufacturing

-

Base line

-

Medium-term

(2030) -

Long-term

(2050)

Selection of Shared Socio-Economic Pathways (SSP) from the Sixth Assessment Report (AR6) of the Intergovernmental Panel on Climate Change (IPCC).

-

Take immediate climate action to limit temperature rise to 1.8 degrees by 2100 and achieve net-zero emissions by the second half of the century.

-

Short-term

1.5 °C -

Medium-term

1.7 °C -

Long-term

1.8 °C

Low Carbon Scenario(SSP1-2.6)

-

-

Limited coordinated action leads to a temperature increase of 2.4 degrees Celsius by mid-century and 4.4 degrees Celsius by 2100.

-

Short-term

1.6 °C -

Medium-term

2.4 °C -

Long-term

4.4 °C

Low Carbon Scenario(SSP5-8.5)

-

- Extreme Heat

- Rainfall-Induced Landslides

- Extreme Cold

- Storms and Extreme Winds

- Wildfires

- Flooding(including River Flooding, Coastal Flooding, Extreme Rainfall Flooding)

- Water Stress and Drought

- In addition to the decrease in the risk of extreme low temperatures, the overall climate physical risk program is trending upwards, with a more pronounced increase in climate risk under the High Carbon Scenario (SSP5-8.5).

- The assessed assets are exposed to 4 main physical risks: water stress and drought, flooding, tropical cyclones and extreme heat.

Transition Risk

-

Business Scope:

operation (CDHORIZON, FEHORIZON ASSET MANAGEMENT and Financial Business), downstream (investment and financing activities)

-

Asset Types:

Chemical industry, building construction, industrial and mechanical engineering, electronic equipment, road transportation and logistics

-

Short-term

(2025) -

Medium-term

(2030) -

Long-term

(2040-2050)

Selected the standard scenario of the Network for Greening the Financial System (NGFS)s to assess the transition risk.

-

High net-zero CO₂ emissions around 2050 through rigorous climate policies and innovations to limit global warming to 1.5°C. Relatively low physical risk, but high transition risk.

-

Temperature rise results

< 1.5°C -

Strict and responsive climate policy

-

Rapid technological innovation

-

Relatively high frequency use of

CO₂ removal technology

-

Assuming only the policies currently in place are retained, GHG emissions continue to increase through 2080, resulting in approximately 3°C of warming and serious physical risks, including irreversible changes such as sea level rise.

-

Temperature rise results

3°C+ -

Keeping current climate policies

unchanged -

Low rate of technological innovation

-

Carbon dioxide removal technology used

at low frequency

- Reputation Risk

- Policy & Legal Risk

- Market Risk

- Technology Risk

- our transition risk arises mainly from owned financial business, the financial situation of its customers is altered by climate transition factors, affecting the company's asset quality and exacerbating credit risk.

- Of the five major industries in which the financial business is assessed, only the electronics equipment industry has an overall opportunity above the risk rating.

Risk Management

In order to facilitate the climate transition, FEHORIZON will continue to regularly assess climate risks and opportunities and look for ways to support the low-carbon transition throughout our value chain. We have established a management practices of the Company itself and its portfolio companies, which enable us to discover potential risk in advance. The Company then identifies the type, degree and cause of risks and its development trend, track and monitor the effectiveness risk management, and take targeted measures to prevent, control and mitigate risks in a timely manner.

-

Risk Identification

Conduct peer benchmarking and gap analysis and identify a list of climate-related risks and opportunities through internal key stakeholder interviews.

-

Risk Assessment

Conduct scenario analysis to assess the impact scope and impact level of climate-related risks and opportunities, and identify risks and opportunities that have a major impact on business strategy and operations.

-

Risk Management

Operational level: Develop and evaluate management measure to address key risks and opportunities.

Business level: Develop a financial impact quantification tool for financial analysis, which will further inform risk management and strategic planning. Ensure mitigation and adaptation measures are in place to address relevant climate risks

-

Risk Integration

Integrate climate-related risks into existing risk management framework and ensure that climate risks are regularly identified and managed.

Climate Target

Taking 2021 as the base year, striving to achieve carbon peaking in 2025, and striving to achieve carbon

neutrality in

the whole value chain by 2050. In response to the Paris Agreement and China’s dual carbon targets, the Group’s science-based targets have been validated by the Science Based Targets initiative (SBTi) in 2025.

- Scope 1 & 2 Emission Targets: Using 2022 as the base year, the Group aims to reduce absolute Scope 1 and 2 emissions by 42.0% by 2030.

- Scope 3 Financed Emission Targets: By 2030, within the Company’s financial leasing and equity investment portfolios, adjust the temperature score of the investment portfolio’s Scope 1 and 2 emissions from 3.2°C in 2022 to 2.44°C in 2030 and adjust the temperature score of the investment portfolio’s Scope 1, 2, and 3 emissions from 3.2°C in 2022 to 2.56°C in 2030.

-

Short-term goal

Striving for Carbon Peaking by 2025. Linear reduction in GHG emissions density per unit of income by 2% per year between 2021-2025 (i.e., 8% reduction over four years compared to the base year).

-

Medium-term goal

Linear reduction in GHG emissions density per unit of income by 4% per year between 2025-2030 (i.e., 20% reduction over five years from the base year).

-

Long-term goal

Striving for full value chain carbon neutrality by 2050.

FEHORIZON Carbon Neutral Target Implementation Pathway

Operational Carbon Reduction

-

Improve greenhouse gas accounting and certification system

Carrying out energy saving and emission reduction, and remodeling and upgrading equipment

Promote green building certification

Purchase or develop green power

Purchase carbon sinks and low carbon assets

Carbon Reduction at the Value Chain Level

-

Development of clean energy-related businesses

Upgrading and replacing clean tech equipment and facilities

Reducing life cycle impacts of infrastructure-related business processes

Developing green, sustainable leasing and green investment and financing businesses

Issuing green bonds

Practicing green operation is the foundation of FEHORZION to promote sustainable operation. The Group strictly abides by the Environmental Protection Law of the People’s Republic of China and other relevant laws and regulations. By setting environmental management goals, strengthening economical use of energy and water resources, enhancing waste management, etc., the Group has explored and applied green and low-carbon operating models and promoted harmony and unity of operation and environmental protection. In 2023, none of the Company’s business operations had significant impact on the environment or natural resources, and no environment violations occurred.

2030 Targets

- Reduction of water consumption per unit of revenue by 25% by 2030 compared with the base year

- Reduction of energy consumption per unit of revenue by 25% by 2030 compared with the base year

- Continue to improve garbage sorting and statistics and management capability, and trace the comprehensive utilization of wastes like domestic waste and large solid wastes