Fehorizon’s Sustainable Finance Framework Received Top Rating for Asian Financial Institutions from Moody’s and Sustainable Fitch

Recently, the international rating services Moody’s and Sustainable Fitch provided their second-party opinions to and rated Fehorizon’s sustainable finance framework (the “Framework”). It’s the highest rating given to the sustainable finance framework of an Asian financial institution ever since Moody’s updated its second-party opinion rating methodology in October 2022. Meanwhile, it’s also been the best result since Sustainable Fitch began to rate the sustainable finance frameworks of Asian financial institutions.

According to Moody’s, the fact that Fehorizon is aimed at providing financing or refinancing services for projects of six green categories and four social categories shows its significant contribution to sustainable development. Specifically, the green categories include renewable energy, clean transportation, sewage treatment & sustainable water management, green building, energy efficiency improvement and pollution prevention; and the social categories include basic education services, basic healthcare services, indirect creation of employment opportunities by providing loans to small and micro businesses, and basic living facilities.

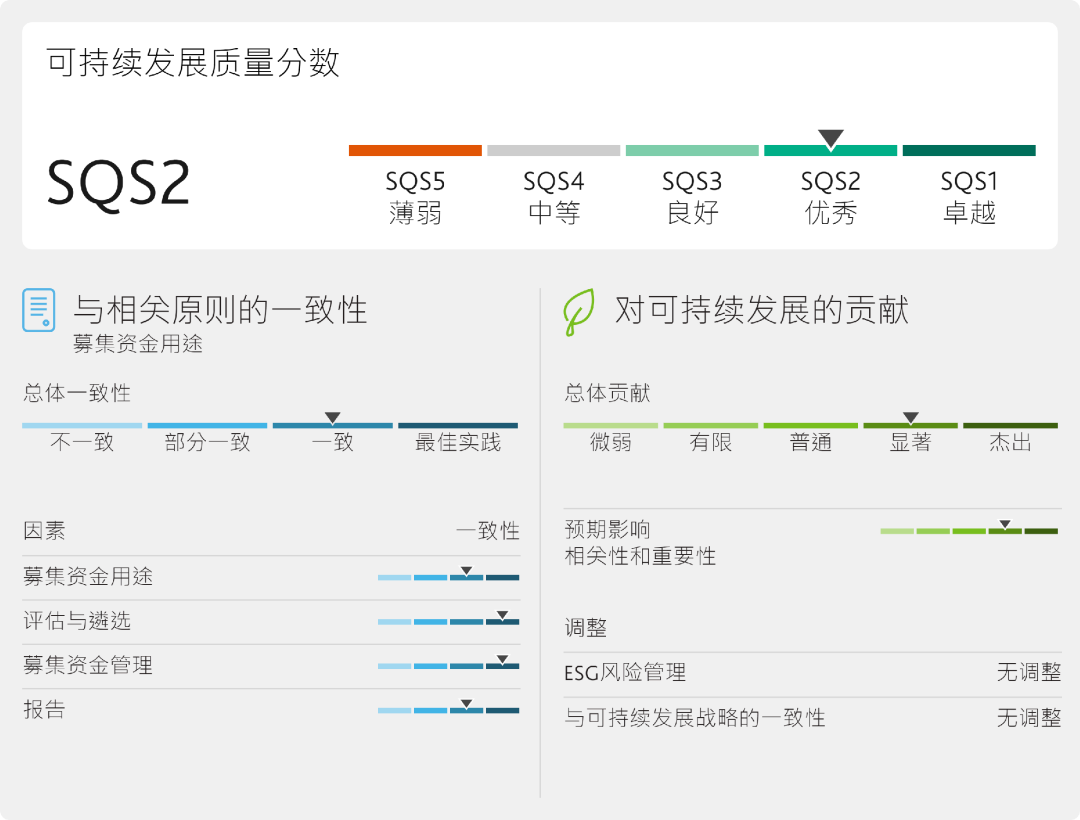

▲ Fehorizon’s sustainable finance framework rated as “excellent” by Moody’s

Sustainable Fitch believes that the issuance of bonds and loans under such green finance framework will help the Company with its sustainable finance business, and contribute to the realization of China’s strategic goal of achieving carbon peaking by 2030 and carbon neutrality by 2060.

Developing Green Finance and Perfecting Management Process

The so-called green finance mainly refers to funding for green projects involving energy conservation & environment protection, pollution prevention, resource conservation and recycling and sustainable economic development. According to international standards and best practices in the market, before issuing a green finance product, the issuer must establish a green finance framework, hire an external agency for its certification, and annonce it to the market.

First released in 2021, the “Green Finance Framework of Far East Horizon” covers the Company’s definition of eligible green assets, the purpose of fundraising, the management of fundraising, the evaluation and screening of green projects, and reports on subsequent fund usage. This September, it was further expanded to the “Sustainable Development Finance Framework of Far East Horizon” by adding 4 categories of social responsibility assets and projects. The enrichment of the Company’s eligible assets and projects of sustainable development finance is conducive to improving the quality of underlying sustainable development assets, enriching the categories of its sustainable development finance products, and further matching the international standards with the expectations of international investors.

Moody’s Opinion of the Advantages of Fehorizon’s Sustainable Finance Framework

» Clear environmental/social goals in conformity with the sustainable development goals of the UN

» Financing for renewable energy technology projects with outstanding contribution to sustainable development

» Clear and transparent project evaluation and selection process

» Quick allocation of raised funds (within 24 months)

So far, Fehorizon has established a perfected governance framework, and has been continuing to improve its decision-making mechanism while maintaining a high governance level. Take the leasing business as an example—the Company has constructed a set of whole-process, all-round, multi-directional and non-stop management system based on the business characteristics. First, each business department comes up with eligible green or social responsibility projects, and determines potential eligible assets according to the eligibility criteria for green or social responsibility projects described in the sustainable finance framework; during the introduction of projects, the Company will conduct a feasibility study and social risk assessment for each project.

Meanwhile, Fehorizon has set up a “sustainable development finance task force” to manage and track the usage of funds raised for sustainable development finance projects, record the usage and allocation situation of funds raised for each sustainable development finance project separately, release annual bond report and annual loan report periodically, and have the Framework assessed by independent agencies including Moody’s and Sustainable Fitch regarding whether it’s in line with the sustainable development finance principles with independent second-party opinion reports issued.

The establishment and constant perfection of Fehorizon’s sustainable finance framework is of great importance, as it reflects the emphasis placed on sustainable development by the Company and its determination and ability to practice ESG in great depth. This time, the top rating and high evaluation by internationally renowned rating services has once again consolidated Fehorizon’s good market image as a company implementing green and sustainable development concepts, and increased its influence in the international finance market.

In the future, holding fast to the development goals of carbon peaking and carbon neutrality as always, Fehorizon will continue to adapt to the trends of sustainable development and economic transition, serve the development needs of real economy, practice the requirements of green development, gradually reinforce the foundation of sustainable development finance with one after another sustainable development finance transactions, and build up the momentum for its ESG innovation to scale new heights continuously.