[ESG Action] Far East Horizon’s Inclusive Finance Business Continuing to Improve Financial Service Accessibility

Small and medium-sized enterprises are an important support for the tenacity of China’s economy and employment. According to the data of Ministry of Industry and Information Technology, by the end of 2021, the number of micro, small and medium-sized enterprises has reached 48 million in China, which makes it the largest and most dynamic group of enterprises and the main force of China’s socio-economic development. Nevertheless, difficulties in and high cost of financing are restricting the development and growth of micro, small and medium-sized enterprises, and even considered a “worldwide problem.”

To complete the “last mile” of financial services, Far East Horizon (03360.HK) practices the ESG development idea thoroughly, and takes “serving real economy, perfecting product and service quality, and optimizing customer service” as an important measure to fulfil its responsibility towards customers. Facing micro, small and medium-sized enterprises, it has launched inclusive finance business and continues to increase its efforts in supporting financial leasing. Meanwhile, it keeps stimulating the innovation vitality and development impetus of micro, small and medium-sized enterprises, to boost the healthy, sustainable, steady and harmonious development of the real industries.

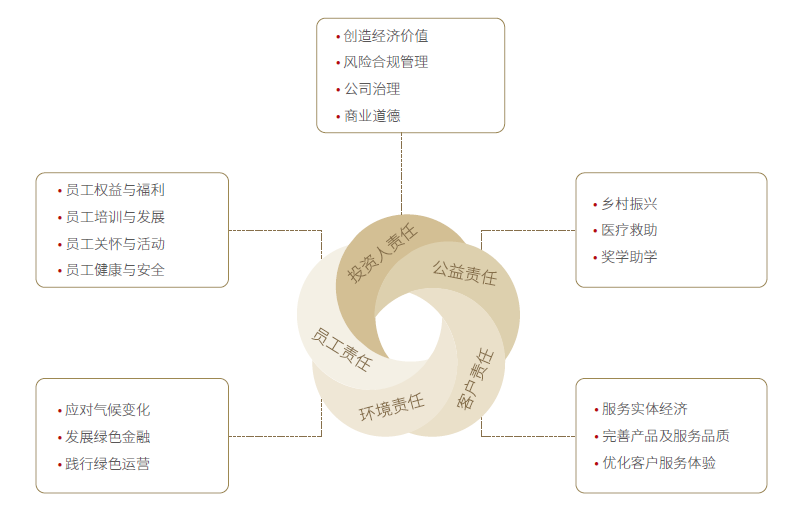

△Far East Horizon stresses five major social responsibilities

01 Flexible and efficient

Meet diversified financing needs

Micro, small and medium-sized enterprises are great in quantity but scattered in distribution. Their financial needs are often in small amount and urgent. The development and growth of micro, small and medium-sized enterprises can’t do without continuous irrigation with financial running water. Focusing on their capital needs for equipment purchase, R&D input, supplementation of working capital, etc., Far East Horizon assists them to reduce their cost and increase efficiency through methods including intensive purchasing and optimization of operation and management, thus contributing to the steady development of micro, small and medium-sized enterprises. Compared to traditional financial services, Far East Horizon’s inclusive finance business is more flexible and efficient, with advantages such as simple procedures, fast approval and high credit line.

Established in 2000, certain compressor manufacturing limited company of Zhejiang Province mainly produces washing machines and electric machinery. In recent years, this enterprise has scaled up with new plants built and a pressure casting production line added. After purchasing new production equipment, it was in dire need of working capital to pay for raw materials in advance, so as to relieve the operating pressure brought by rising raw material price. After completing investigation and survey, Far East Horizon provided funds for this enterprise with “direct leasing of new equipment + leaseback of existing equipment” so that it could buy in materials at low price and increase corporate profits.

02 Balanced development

Alleviate financing problems in remote areas

Far East Horizon attaches great importance to regional balance in the allocation of financial resources, devotes itself to improving accessibility to financial services for micro, small and medium-sized enterprises in remote regions, makes efforts to solve their difficulty in financing and high cost of financing. In 2021, Far East Horizon continued to provide financial services for micro, small and medium-sized enterprises in regions including northern Shaanxi and Gansu, with financing scale approaching 50 million yuan.

Located in the loess tableland about 300km from downtown Xi’an, certain petroleum machinery company manufactures pipeline for China National Petroleum Corporation. Due to the pandemic, the price of the raw material needed by this enterprise rose sharply, and the production of many orders was postpended. In order to guarantee delivery on time and avoid an increase in cost resulting from continuously rising raw material price, the enterprise needed a great amount of money to purchase raw materials in a short time. After learning about its needs, Far East Horizon came up with a customized old equipment leaseback solution, and solved the enterprise’s financing problem with approval completed and loan granted within a week.

The key lies in the skill of balancing between priorities. Far East Horizon’s inclusive finance business “draws water to irrigate” micro, small and medium-size enterprises in remote regions, helps them to strengthen foundation and yield fruitful results, promotes the development of remote regions to the next level, and adds new impetus to national economic development.

03 Technology enabling

Continuously optimize customer service system

In order to construct a scientific, advanced and perfect inclusive finance operation system and effectively support the development of micro, small and medium-size enterprises, centering around customer experience, Far East Horizon fully exploits means of technology to empower micro, small and medium-size enterprises’ customer service, responds to customer needs and improve customer service efficiency by continuously optimizing operation process, and provides micro, small and medium-size enterprises with “standard, intelligent and online” services that are highly efficient and convenient.

At the inclusive customer service platform of Far East Horizon, one-stop online service keeps improving accessibility to financial services for micro, small and medium-sized enterprises. After customer’s online submission of financing need, business personnel conducts examination and approval including video call and remote due diligence with technologies such as AI, big data and risk engine, and the customer can get funding quickly upon completion of electronic contract signing. As of now, Far East Horizon has completed cooperation with micro, small and medium-size enterprises for over 10000 times through electronic signing. Behind the data is Far East Horizon’s utilization of technological means to analyze needs and refine services time and time again, as that all financing problems of micro, small and medium-sized enterprises can actually receive attention and get solved efficiently.

In addition to meeting the capital needs of micro, small and medium-sized enterprises, Far East Horizon has been practicing the ESG development idea in great depth, with no efforts spared in strengthening customer ESG risk control through methods including closely monitoring the trends of national macro policies and industrial policies, following the latest news and risk situations of industries with relatively high ESG risk, and severely restricting the import of ESG risk enterprises with heavy pollution and excessive production capacity.

Deeply rooted and growing luxuriantly, Far East Horizon continues to expand the depth and scope of its services today. Facing over a dozen of industries such as machining, electronics, textile, printing, automotive and healthcare, its inclusive finance business has covered top 100 cities in China including Shanghai, Suzhou, Shenzhen, Tianjin, Jinan, Zhengzhou, Nanjing, Ningbo, Chengdu, Wuhan, Guangzhou and Xiamen. Far East Horizon has served over 7000 micro, small and medium-sized enterprises with an input of nearly 20 billion yuan.

In the future, Far East Horizon will adhere to the core idea of responsibility of “creating shared value and promoting harmonious development,” pay continuous attention to the actual needs of small and medium-sized enterprises, boost the development and take-off of micro, small and medium-sized enterprises, strive to serve the high-quality development of the real economy, and create outstanding value.

*Actions corresponding to the sustainable development goals of the United Nations