Good Finance in Five Dimensions—Fehorizon Takes Multiple Measures to Promote the High-quality Development of Finance

Good Finance in Five Dimensions

Finance is the blood that runs in the vessels of national economy;

Real industry is the backbone of national development.

“Integrating global resources and promoting industry development”

has always been the mission of Fehorizon for over a decade.

We believe that only by keeping a foothold in people’s livelihood and caring about entities can we make a difference and build a powerful nation with finance.

As from today, the official WeChat account of Fehorizon will launch a series of topics successively under the theme “Good Finance in Five Dimensions”.

With serving entities as the soul and innovative practice as the manifestation, it will narrate exemplary stories of how Fehorizon serves the real economy as a financial enterprise.

On March 13, Fehorizon released its 2023 annual report. With asset size exceeding 350 billion yuan and asset quality continuing to improve, Fehorizon has been included in the Forbes Global 2000 for seven consecutive years. Behind those glorious achievements, some figures are still more dazzling—the Company has served more than 15000 private enterprises (above 70% being manufacturing enterprises) with financial support exceeding 400 billion yuan. Among these enterprises, more than 1100 of them have grown from weak to strong and eventually realized successful initial public offerings, and almost all of them are dedicated to photovoltaic, electronic components, IT and pharmaceutical manufacturing industries and growing stronger by the day.

Since we offered our first partner development fund in 2001, 23 years have gone by, and we’ve spent every cent on real economy. Facing the new challenges of the times—“vigorously developing technology finance, green finance, inclusive finance, old-age care finance and digital finance,” Fehorizon sticks to the “finance + industry” development strategy to innovate service mode and enrich the connotations of service. It is our belief that the real driving force for national and industrial development lies in the high-quality services we provide for each client.

Empowering with technology—exploring a new driving force

“New-quality productivity” is one of the hot words of the NPC and the CPPCC this year, and also the key to realizing economic development in these days. The nature of new-quality productivity is to develop advanced productivity, which relies on high quality and features innovation. For quite a few scientific and technological innovation enterprises, financing is as challenging as technological innovation. Fehorizon always strives to find the joining point between technology and finance, help every tiny but shining idea and technology to take root in the market from the very beginning of conception and R&D, and accelerate the formation of new-quality productivity with a continuous flow of financial support.

A certain Shandong-based leading enterprise in the domestic tyre industry is a national high-tech enterprise and national exemplary enterprise in technological innovation with annual sales reaching 26 billion yuan. In as early as 2020, to help the enterprise to upgrade production equipment and boost production, Fehorizon offered 100 million yuan through financial leasing, and thus began its long-term support for the enterprise’s innovation and development. Today, with its advantages in cross-border finance and following the footsteps of the client’s overseas factory construction, Fehorizon will further provide services including export leasing and overseas USD credit, to help Chinse enterprises to march into the world.

In addition to long-term companionship, Fehorizon is even more concerned with discovering the demand of high-tech enterprises for funds, and meeting them half-way by upgrading its own scientific & technological system. In 2023, the latest generation of Fehorizon’s core business system was officially lunched. Through accurate recognition with big data technology, it can reach clients with demand proactively. Throughout the year, it has provided credit extension services to nearly 2000 clients and implemented over 60 billion yuan of financing, which has greatly enhanced the accessibility of financial services. Also, its service efficiency has been further increased with the utilization of means including electronic signing of contract, video interview, remote video due diligence investigation, automatic identification & verification of invoice, automatic check and registration of asset ownership, automatic identification and comparison of contract text, etc.

Meanwhile, the private equity investment institution under Fehorizon has been watching the field of scientific and technological innovation on a long-term basis. It offers support to relevant enterprises at the incubation stage through technological innovation funds, and helps innovation enterprises to convert “patents” into “profits,” to truly form the virtuous cycle of “industry—technology—finance.”

Green practice—upholding sustainable development

“New-quality productivity” is in essence green productivity, and “green” is also the base color of Fehorizon’s operation and development. The Company upholds green development, and takes low-carbon transition as the priority among priorities during its development. Following its commitment to whole-value-chain carbon neutrality in 2022, Fehorizon has further conducted Scope 3 greenhouse gas inventory. Using the PCAF method, it has for the first time carried out accounting of the total carbon emissions of its financial business, and thus laid the foundation for developing scientific carbon targets in the next step.

In 2023, the sustainable finance framework released by Fehorizon received top rating for Asian financial institutions from the international rating services Moody’s and Sustainable Fitch. By means of issuing green ABS, green ABN and sustainable development bonds and signing green club loan agreements, it offers financial support for the green development of the society and contributes to the construction of ecological civilization and an environment-friendly society.

In terms of financial investment, Fehorizon reduces the carbon emissions of investment portfolios by making policies and restricting business cooperation with high-polluting and high-emission enterprises. Besides, in accordance with the requirements of the catalogue of industries for green and low-carbon transition and the catalogue of green bonds, it encourages financial business including financial leasing to shift towards green and sustainable industries, and helps industries to realize green and low-carbon transition and development. As of now, Fehorizon’s green financial leasing assets have exceeded 80 billion yuan.

“Accurate drip irrigation” is not the end; Fehorizon also “sows seeds.” Based on its own management ability and integrated internal and external resources, Fehorizon offers clients sustainable development solutions, and helps them with consultation and technical solutions in areas including ESG information disclosure, sustainable strategy planning, carbon neutrality goal planning, greenhouse gas emission inventory, energy conservation & emission reduction technical services, clean power station development, CCER development and transactions, etc. To drive the ESG development of the industry, Fehorizon also participated in the compilation of standards and guidelines including the Environmental, Social and Governance (ESG) Reporting Guidelines for Financial Leasing Enterprises, the Annual Development Report of Shanghai on Green Leasing, and the Innovative Exploration and Development Practice of Green Leasing of Shanghai, to protect the lucid waters and lush mountains with united efforts in finance.

Inclusive finance for micro and small enterprises—stimulating new vitality with service

Micro, small and medium-sized private enterprises are the “capillaries” and “nerve endings” of the real economy. Catering to the public, Fehorizon empowers the operation and development of micro, small and medium-sized enterprises with inclusive finance. In 2023, Fehorizon’s “Inclusive Series—2023 Far East Phase I Asset-backed Special Plan for High-quality Development of Micro and Small Enterprises” was successfully issued at the Shanghai Stock Exchange with a size of over 1.5 billion yuan. This is the Company’s first ABS for the high-quality development of micro and small enterprises, and 100% of the lessees in the asset pool are micro and small enterprises in the real economy.

So far, Fehorizon Inclusive (a specialized platform under Fehorizon engaged in financial leasing for micro, small and medium-sized enterprises) has served more than 11,500 micro, small and medium-sized enterprises cumulatively and invested over 36 billion yuan. What’s worth mentioning is that, targeting national technologically advanced “little giant” enterprises—Fehorizon Inclusive’s key clientele, the Company has served over 2000 enterprises, invested nearly 30 billion yuan through various financial services, and truly helped more “saplings” to grow into “towering trees.”

Jintao Mold is a small/micro business in Ningbo, which mainly produces die-casting molds and die-casting products. Established in 2023, Jintao Mold only has a rented factory and old equipment, and its demands can hardly be satisfied with the general financing products on the market. Even with other guarantee measures, due to cumbersome bank procedures and a long approval cycle, it would take 2-3 months to go through the complete loan process; and without new equipment in place, it’s difficult to complete orders in time. After learning about this situation, Fehorizon immediately started research and investigation, and had the approval process competed within a week via the “green channel” of its direct leasing product. Thus, the enterprise proceeded to production quickly upon the arrival of new equipment, and bid farewell to the lengthy loan approval process.

Strong wind arises from the ground, and big waves develop from ripples. Executive Director, Chairman, and CEO of Fehorizon Mr. Kong Fanxing said: “Fehorizon chooses to grow with its clients along the way. The small enterprises in the industry today are probably big enterprises in the future. In fact, many of the big enterprises among our clients were small enterprises over a decade ago.” The sizes of enterprises vary, but the demands of clients are much the same. By actively injecting a constant flow of funds into micro, small and medium-sized private enterprises, Fehorizon helps them to achieve high-quality development, which is exactly the idea of “finance for the people” understood and practiced by Fehorizon.

Heart-warming care for the elderly—innovative combination of medical and old-age care services

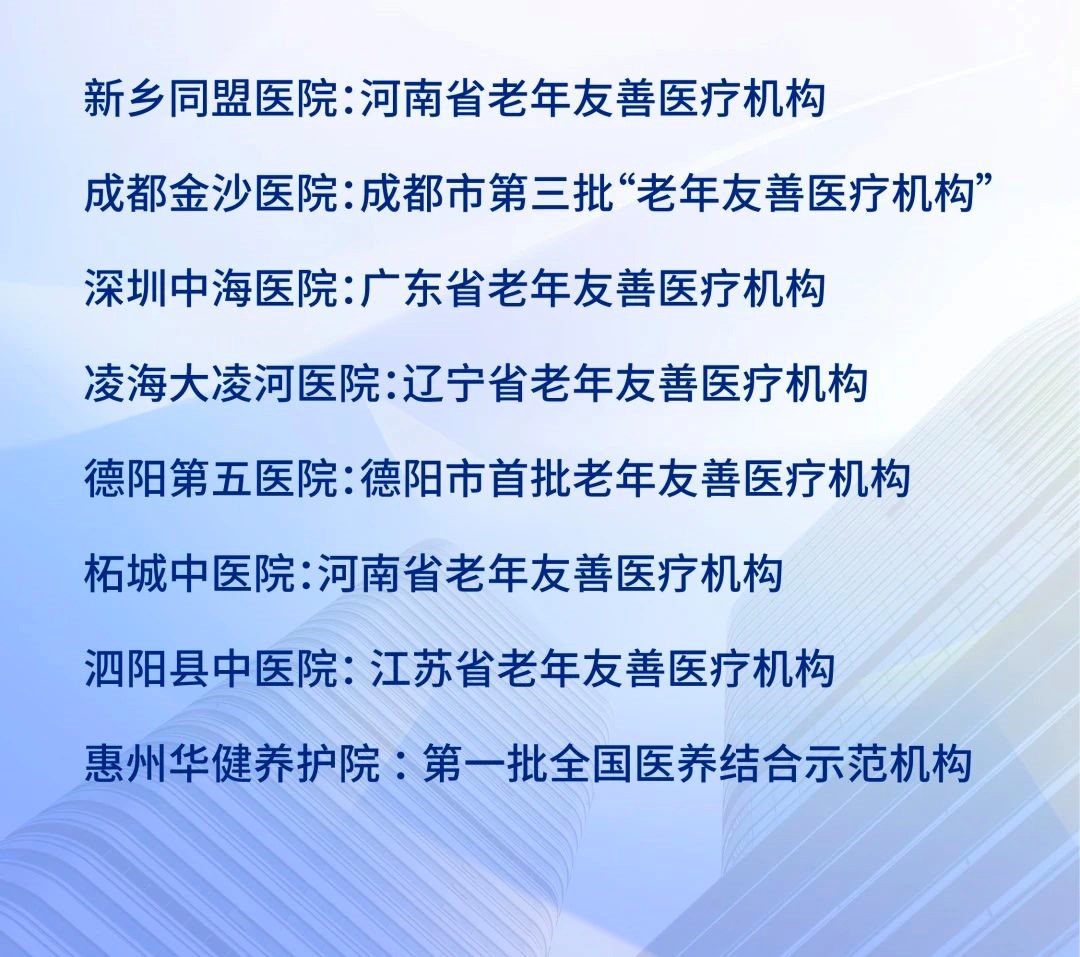

To provide medical and nursing services for the elderly is the necessary requirement of developing “finance for the elderly” and concerns each family and the people’s livelihood. Under the industry sectors of Fehorizon, HCHORIZON is a large social medical platform in China, with up to 25 member hospitals across 13 provinces, covering nearly 30 counties and cities. Surrounding the “medical + old-aged care” service mode, HCHORIZON has established a standardized operation and management system integrating “medical, rehabilitation, nursing and old-age care services,” to provide the elderly population with “intimate, honorable, reliable and trusted” healthcare and elderly care services.

The Huizhou Huakang Hospital in Guangdong is the first hospital to join HCHORIZON. Through continuous and intensive efforts in medicine and arrangement in advance, it has integrated medical and old-age care resources and established the Huajian Nursing Home integrating old-age care and medical rehabilitation. Today, it continuous to deepen the service mode combining medical and old-age care services, to provide the elderly with integrated and continuous elderly care services of high quality.

▲Huizhou Huakang Hospital

In 2023, Mr. Tong, an 88-year-old man with diabetes, had pressure sores due to poor blood circulation resulting from decreased body functions and long-term bedrest. To alleviate his physical symptoms and anxiety, Mr. Tong’s family sent him to the Huajian Nursing Home for professional care. Since Mr. Tong had multiple diseases accompanied by various complications, it was quite a challenge to provide nursing care for him. While providing old-age care services to Mr. Tong, the Huajian Nursing Home also had a chief physician of internal medicine from the Huizhou Huakang Hospital to offer medical guidance in person, and appointed professional nurses to carry out medical and nursing services and assist in rehabilitation. After 4 months of treatment, Mr. Tong has basically returned to health, and now he chooses to stay at the Huajian Nursing Home to continue to receive old-age care.

▲Banner for the Huajian Nursing Home from the patient’s family after recovery from pressure sores

Meanwhile, the Huizhou Huakang Hospital has opened a green channel for the elderly patients to receive timely treatment before payment. It offers a range of professional medical services including emergency medical services, 24/7 medical consultation services, bedside rehabilitation trainings by rehabilitation technicians, etc. Its thoughtful services have realized “major diseases treated within the hospital, minor illnesses cured within the ward, and rehabilitation services at bedside.” Thus, the Huajian Nursing Home became one of the first batch of institutions to receive the title of “Exemplary Institution for Combination of Medical and Old-age Care Services” in November 2023, and also the only institution to receive this title in Huizhou City.

▲Certain hospitals under HCHORIZON with approval of the state and relevant provincial and municipal departments

Digital transformation—creating a highly efficient new routine

As an important tool to stimulate economic development and revitalize private enterprises, supply chain finance service plays an irreplaceable role. Under the background of the digital transformation of the supply chain, highly integrated supply chain and digital technology have become an important measure to develop supply chain finance service. Based on its “intelligent supply chain + financial technology” abilities, with technologies including internet cloud computing and big data, Fehorizon has created the Fehorizon Yilian Supply Chain Technology Platform catering to all needs throughout the supply chain, to provide technology services related to receivables turnover and transactions through the entire process for clients and institutions such as core enterprises, suppliers and funding parties. At present, the platform has attracted over 500 core enterprises and over 600 suppliers, and issued more than 1000 certificates with the total amount exceeding 5 billion yuan.

The end of year is the payment season for the engineering construction industry. Especially when the Spring Festival is approaching, in order to pay the wages for migrant workers, the acceptability of sub-contractors to payment methods will increase exponentially. In December 2023, due to the tight capital flow of a certain client, Fehorizon recommended “Hong Lian Bao”—the latest product of the Fehorizon Yilian Supply Chain Technology Platform. By linking up core enterprises, banks and suppliers for the client, it allowed over 20 suppliers to receive 30 million yuan in payment right before the Spring Festival, and also solved the financial dilemma for enterprises by postponing the payment period. Data shows that the “Hong Lian Bao” launched in August 2023 is now directly linked to multiple banks including the Bank of China, the Bank of Shanghai, the Huishang Bank, and the Zheshang bank, and serves about 250 core enterprises and over 500 suppliers, with financing totaling more than 2 billion yuan. By applying the credit of core enterprises upstream, it can effectively solve the difficulties in financing and the high cost of financing for suppliers.

Such transformation from “tentative” to “routine” practice is actually not new to Fehorizon. The Company has always been actively exploring digital transformation and reinforcing the “firewall” of operation. Through machine learning with massive amounts of internal and external data and building an intelligent risk prediction model, the intelligent asset warning platform constructed by Fehorizon has realized quick response and handling for enterprises with potential risks; in 2023, it captured over 2400 effective risk signals all year round. The intelligent platform for clients enables automatic processing including automatic repayment prompt for amounts due and automatic crediting and invoicing upon receipt of payment, which effectively improves the repayment experience and the financial transaction efficiency for clients and truly realizes “convenient and efficient self-help services throughout the whole process.”

Empowering with technology

Practicing green development

Serving micro and small enterprises

Innovating care for the elderly

Carrying out digital transformation

With building a great financial power as the goal,

through more explorations and practices with Far East characteristics,

we strive to realize good finance in five dimensions.

Only with faith in heart can go far.

Along the way of providing high-quality financial services for the development of real economy, Fehorizon keeps marching forward.