Fehorizon’s MSCI ESG Remained A for Further Recognition of Its ESG Practice

Hot

New

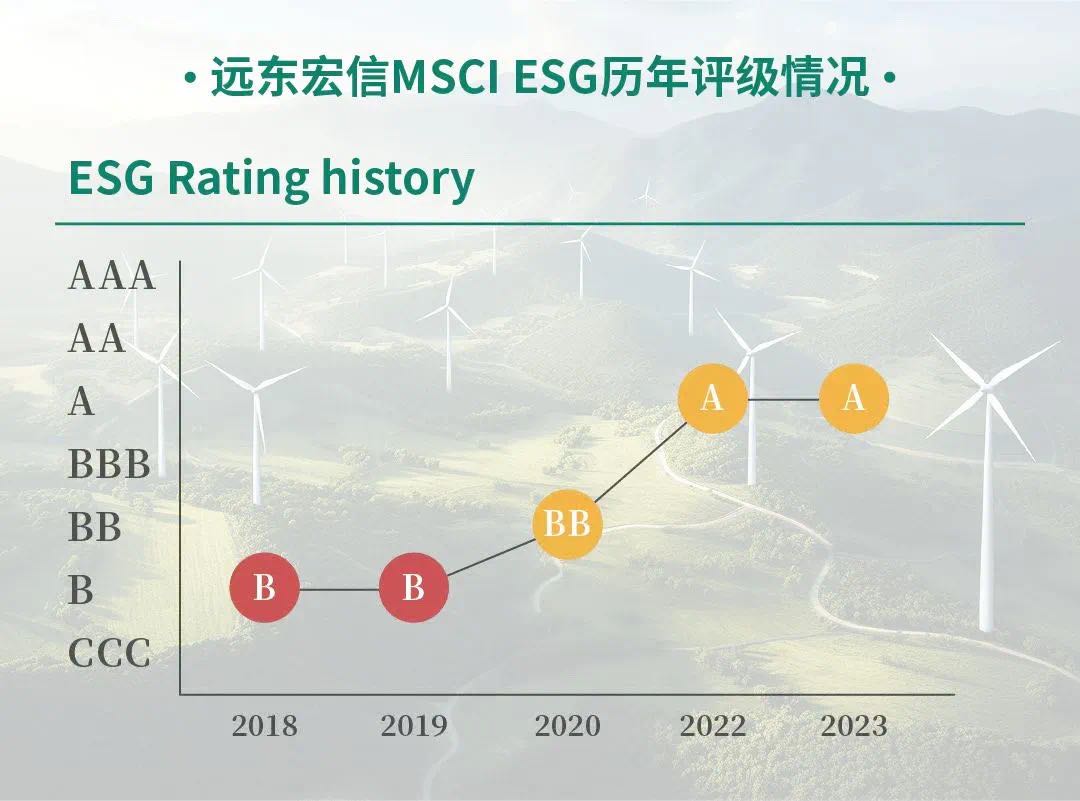

Recently, the world-renowned rating agency Morgan Stanley Capital International (MSCI) released the latest ESG rating for Fehorizon. Due to its excellent and stable ESG management practice, in 2023 Fehorizon’s MSCI ESG rating remained A, a leading level in the domestic diversified financial industry. So far, Fehorizon received A in MSCI ESG ratings for two consecutive years.

MSCI ESG ratings is one of the ESG assessment systems most recognized by global institutional investors, and the results of MSCI ESG ratings serve as an important basis for decision making by major institutional investors around the world. According to the latest results of ESG ratings in 2023, 62 diversified financial companies worldwide have been given ESG ratings publicly by MSCI.

The latest MSCI ESG ratings report shows that Fehorizon’s scores in environment, social and governance exceed the global peer average, and are slightly higher than its scores last year. In terms of specific issues, the Company’s management of issues including carbon emission, financing availability, corporate governance and corporate conduct has gained recognition of MSCI, which is reflected as improvement of scores to varying degrees. Among its latest scores for specific issues, the score for “corporate conduct” stays ahead of competitors in the industry; the score for “carbon emission” has increased considerably to be the highest among its peers globally; and its score for “financing availability” has made a major breakthrough and surpassed the industry average level.

At the same time of developing its own business, Fehorizon has always been attaching great importance to sustainable development and social value creation, and remained devoted to advocating sustainable development with real actions in ESG practice. The fact that its MSCI ESG rating remained A this year constitutes solid evidence that Fehorizon is making steady and firm progress in the field of ESG.

Highlights of Fehorizon’s ESG Actions

By the end of 2022, Fehorizon’s Board of Directors examined and passed a bill named “Company Carbon Goal Planning” and released its carbon neutrality goal and strategy. It is clarified that, with 2021 as the base year, the Company will strive to achieve carbon peaking by 2025 and realize whole-value-chain carbon neutrality by 2050.

According to plan, Fehorizon will fulfil its promise and verify the completion of its science-based targets (SBTi) in 2 years, and issue the first report in compliance with the requirements of the ISSB’s IFRS S2 Climate-related Disclosures and the Task Force on Climate-Related Financial Disclosure (TCFD), to steadily promote the smooth realization of the Company’s carbon neutrality goal by perfecting analysis and assessment.

To complete the “last mile” of financial services, Fehorizon practices the ESG development idea thoroughly, and takes “serving real economy, perfecting product and service quality, and optimizing customer service” as an important measure to fulfil its responsibility towards customers. Facing micro, small and medium-sized enterprises and enterprises in remote regions, it has launched inclusive finance business, developed an online applet/APP, expanded its online business channels and set up offices in 31 Chinese cities, thus continuing to increase its efforts in supporting financial leasing, stimulate the innovation vitality and development impetus of micro, small and medium-sized enterprises, further enhance the financing availability for them, and boost the healthy, sustainable, steady and harmonious development of the real industries.

Fehorizon consolidates the foundation of governance, and continuous to optimize its corporate governance framework. A special committee under its Board of Directors is responsible for the management of moral issues. It explicitly discloses detailed rules of “anti-corruption” and “anti-bribery” regulations and the whistleblower protection system, and promotes actions related to anti-money laundering strictly and solidly.

Scan and follow,

FEHORIZON official account